who pays sales tax when selling a car privately in florida

You may voluntarily file and pay taxes electronically. However if you pay 20000 or more in sales and use tax between.

Florida Car Sales Tax Everything You Need To Know

It should be noted that the local tax is only applied to the first 5000 dollars of the cost of the vehicle.

. Do not let a buyer tell you that you are supposed to. Again exercise caution when purchasing a used vehicle from a dealer or an individual. You will pay less sales tax when you trade in a car at the same time as buying a new one.

What documents do I need to privately sell a car in Florida. An out-of-state dealer who does not have a Florida sales tax number buys a motor vehicle for resale or lease. If you get.

The state bill of sale or Notice of Sale andor Bill of Sale for a Motor Vehicle Mobile Home Off-Highway Vehicle or Vessel Form HSMV 82050 can be downloaded and printed. Print or Download Your Customized Bill of Sale in 5-10 Minutes. You pay 1680 in state sales tax 6.

20000 purchase price x 006 sales tax percentage 1200 sales tax owed. Additionally Florida law presumes any person firm partnership or corporation that buys sells. License plates and registrations buyers must visit a motor vehicle service center to register a vehicle for the first time.

Florida law prohibits the parking of any vehicle on public right of ways or on private property for the purpose of sale without the permission of the property owner. Collect the buyers home state rate up to Florida 6. Its illegal in Florida to sell a vehicle privately with an existing lien.

But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. Once the buyer has the vehicle registered under his name he must pay to sell Texas. Florida collects a 6 state sales tax rate on the purchase of all vehicles.

Who Pays Sales Tax When Selling A Car Privately In Florida Form 1181E Download Fillable PDF or Fill Online. Dealer to collect and report Florida sales and use tax. Ad Receive Car Selling Tips Pricing Updates New Used Car Reviews More.

According to the Florida Department of Highway Safety its best to complete the transaction at the tax collectors office. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in with a maximum tax rate of 15. You will pay less.

Thereafter only 6state tax rate applies. Ad Print or Download Your Customized Bill of Sale in 5-10 Minutes for Free. When I sold private owned cars A few times I gave the buyers the title and signed it.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. In Florida if you buy a 30k car you would owe 6 which is 1800.

Additionally Florida law presumes any person firm partnership or corporation that buys sells. The local surtax only applies to the 1st 5000. If you sell more than two motor vehicles in any.

Answer 1 of 14. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. Proof of Ownership Buyers should ask to see the title to verify VIN and.

For example a used car sold for 3000 the buyer can put down 2000 if he chose or 3000 the exact price. You pay 25000 for the new car saving you 5000. Visit the Departments Florida Sales and Use Tax webpage.

Florida collects a 6 state sales tax rate on the purchase of all vehicles. Or private tag agency. Do I have to pay sales tax when I transfer my car title if the car was given to me.

To sell the motor vehicle the lien first has to be satisfied. Florida collects a six percent sales tax on the purchase of. Instead the buyer is responsible for paying any sale taxes.

The buyer will have to pay the sales tax when they get the car registered under their name. Who Pays Sales Tax When Selling A Car Privately In Florida. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes.

However the seller must sign over the title to the buyer and the buyer must take the appropriate steps to transfer the title into his or her name see Registration Titling. It is legal to buy or sell a vehicle without a registration. Doing so protects you from civil liability and other headaches that could occur if.

The local surtax only applies to the 1st 5000. To calculate how much sales tax youll owe simply multiple the vehicles price by 006625. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

Remember the sales price does not include sales tax or tag and title fees. Check that the VIN appears the same on the title certificate as it does on the vehicle. Under Florida state law the Florida Department of Revenue collects 6 sales tax on 28000 which is the advertised full purchase price of 30000 minus the 500 dealer discount and 1500 trade-in allowance but not minus the 3000 manufacturers rebate.

If you buy a car for 30000 you would typically owe a six percent sales tax which comes to 1800. Who pays sales tax when selling a car privately in Florida. No local surtax charged.

This is generally referred to as curbstoning. An electronic secure title reassignment form form HSMV 82994 or HSMV 82092 A title replacement form HSMV 82101 if the original paper title has been lost. It will need to be complete and then filed with your local county tax collector office.

The buyer must pay Florida sales tax when purchasing the temporary tag. Sales to someone from a state with sales tax less than Florida. If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax.

This important information is crucial when youre selling. Under the Sales Tax Exemption Certification section of the application the new owner is required to declare that the transfer of ownership is exempt from tax as a gift. Fully executed Form DR-123 must be signed at time of sale.

I then asked him to fill in a sale price later. Expect to pay these fees to a motor vehicle service center when transferring ownership. If your trade-in is given a value by the dealership of 10k then you would only owe 1200 a savings of 600.

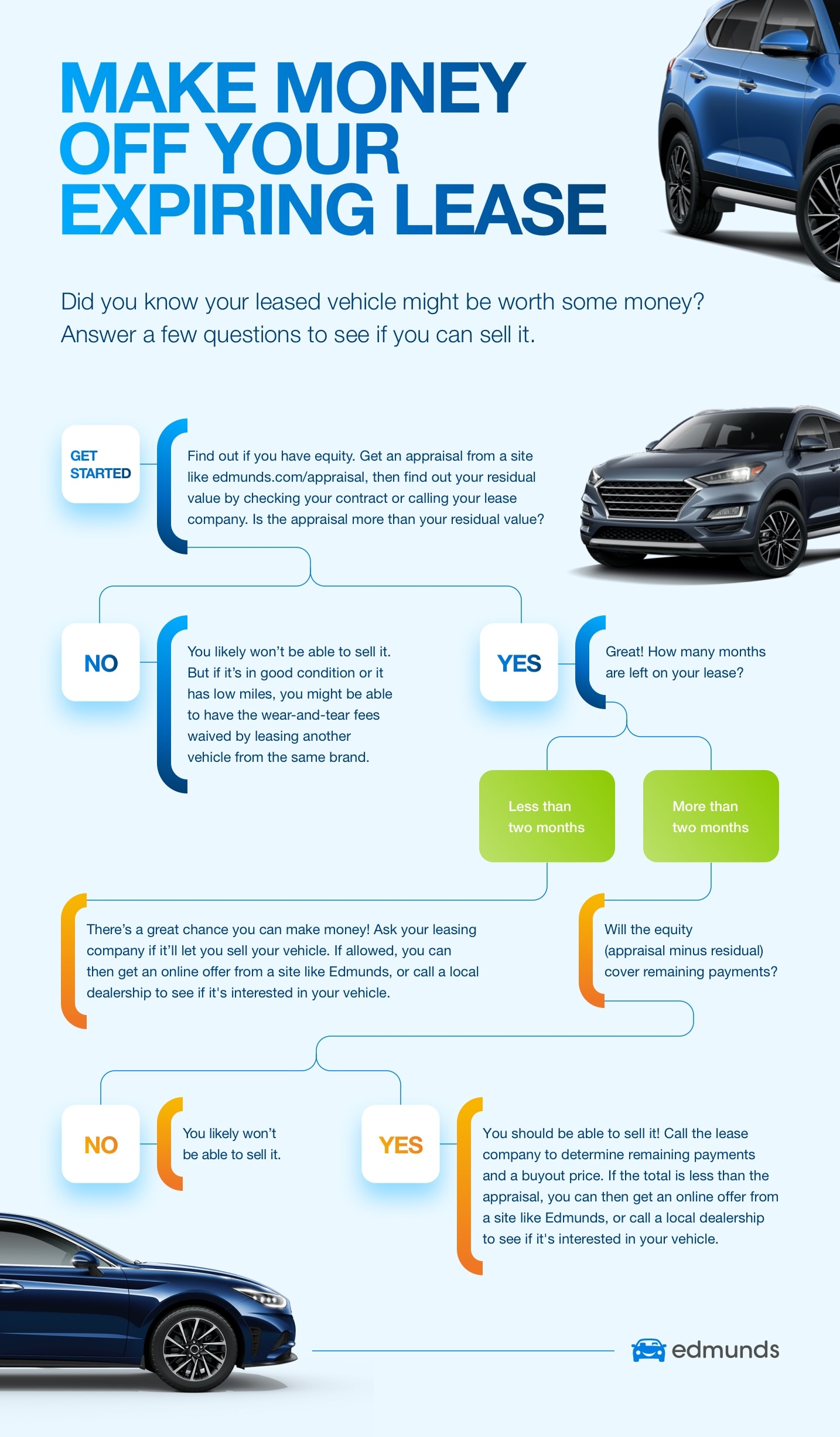

Consider Selling Your Car Before Your Lease Ends Edmunds

Florida Vehicle Sales Tax Fees Calculator

Florida Vehicle Sales Tax Fees Calculator

A Complete Guide To Car Dealer Fees Carfax

7 Ways To Protect Yourself When Selling A Car Kelley Blue Book

Vehicle Sales Purchases Orange County Tax Collector

How To Calculate Florida Sales Tax On A Car Squeeze

Site Work Is Slated For Early 2018 For Sanford Heritage Park Orlando Florida Sanford Heritagepark Simplicityre Florida Homes For Sale Florida Home Park

Florida Vehicle Sales Tax Fees Calculator

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Reasons Why Hiring A Title Company Is Important Title Insurance Title Company

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Car Financing Are Taxes And Fees Included Autotrader

Which U S States Charge Property Taxes For Cars Mansion Global

Selling A Car In Florida A Former Dealers Advice